9 Best Forex Brokers in the UK for 2024

And the fact of the matter is you don’t necessarily have to choose just one or the other. 2 Message from Depositories: a Prevent Unauthorized Transactions in your demat account > Update your mobile number with your Depository Participant. There is probably no lower barrier to entry for traders looking to begin using algos than Botsfolio. These apps do more than allow you to trade while you’re on the move. Complexity is a factor that often separates these two approaches. Financial Industry Regulatory Authority. Pick a stock and watch it for three to six months to see how it performs. However what you need to know is that when those bugs occur that you have good customer services to back you up. Today, candlesticks are among the most widely used method of graphically depicting price charts in the financial markets. 76% of retail investor accounts lose money when trading CFDs with this provider. Read more about risk management in trading. Some candlestick patterns like hammer and doji tells you that the existing trend is ending and a new one is about to form. Everyone works to create some version of their own freedom and optionality, but understanding individuals’ or families’ wants and needs can help create simple roadmaps of where they want to be in the future. Trusted by over 2 Cr+ clients, Angel One is one of India’s leadingretail full service broking houses. Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. With authorRoger Lowenstein. A 5% trading fee means a 10% reduction on your profit for every profitable trade buying and selling or a 10% increase in your loss for a losing trade. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. All investments involve risk and loss of principal is possible. When one’s outlook on the market is largely bearish, one might use a double options trading strategy called a Bear Call Spread.

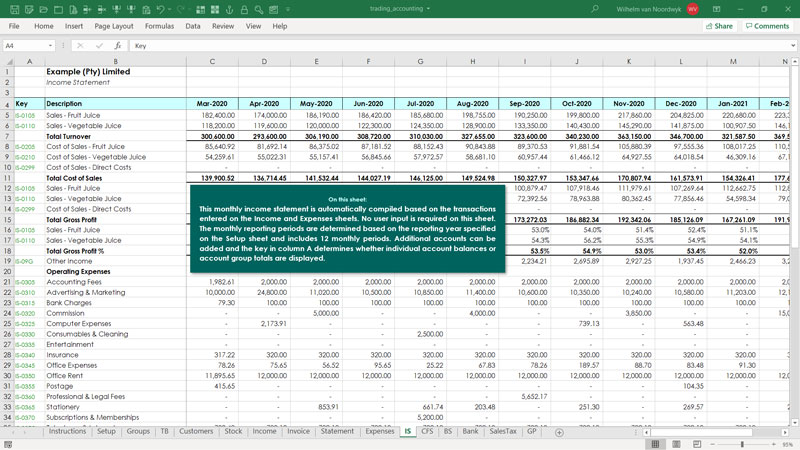

Trading and Profit and Loss Account Format

It’s like you and the market are 100% connected and the money falls into your account. Bajaj Broking provides you with an option to open a free Demat and trading account with zero account opening charges and zero AMC for 1st year through its Freedom Pack AMC of Rs. In 2005, the Regulation National Market System was put in place by the SEC to strengthen the equity market. TBNZ complies with the custodian obligations under the Financial Markets Conduct Regulations 2014, including the appointment of an independent auditor to undertake a statutory client funds assurance report each year, a copy of which is provided to the NZ Financial Markets Authority. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Using scalping for futures trading is a high risk and high https://pocketoptiono.website/ return strategy. It can also take place in an OTC trade over the counter, which means off market contracts negotiated between power buyers and sellers. In brief, there are two main ways to trade the Double Bottom Pattern. By leveraging tick charts alongside other analysis techniques, traders can improve their decision making and optimise their trading strategies. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. Please answer this question to help us connect you with the right professional. Programs, rates and terms and conditions are subject to change at any time without notice. Typically, the flag’s formation is accompanied by declining volume, which recovers as price breaks out of the flag formation.

DISCLAIMER

Great customer support. Upstox is preety good overall, although the brokerage charges are a bit higher than zerodha I have rarely seen technical glitches atleast in execution of trades not to mention the margin trade facility of 2x at an interest of 18% didn’t found it in zerodha tho. This https://pocketoptiono.website/vt/ causes a stagnation in the short term and once the market decides to break the support, “small sellers” are active and make the price decrease. Our commitment to providing unbiased, comprehensive reviews of forex brokers is rooted in extensive research and expert analysis. Axi makes no representation and assumes no liability with regard to the accuracy and completeness of the content in this publication. The disadvantage is that encourages impulse investing. Pick the plan that suits you best and add tax wrapped accounts to keep more of any gains. Shares on a stock exchange are from companies who have decided to sell their shares to the public so people across the world, sometimes these are called retail investors. Reliability You should look for safe and reliable apps, such as Zerodha Kite and Angel One. If you’re looking for a guaranteed return, perhaps a high yield CD might be better. All ETFs are subject to management fees and expenses; refer to each ETF’s prospectus for more information. IMPACT app, IBKR mobile app.

Way of the Turtle: The Secret Methods that Turned Ordinary People into Legendary Traders

XTB and eToro also offer low cost stock and ETF trading. These real life stories will tell you what it takes to become successful and what you should never do in trading. Trading Volumes: This refers to the number of times, the share of a company was purchased and sold throughout the day. India boasts a diverse range of trading platforms designed for both novice and experienced investors. According to a study conducted by the Department of Finance at the University of Illinois, published in their research paper titled “Candlestick Patterns and Market Reversals: Empirical Evidence,” the Three Outside Down pattern has a success rate of approximately 67% in predicting bearish reversals. To learn more about our rating and review methodology and editorial process, check out our guide on how Forbes Advisor rates investing products. Intraday trading experience is elevated for a trader with Bajaj Broking’s simple and effective user interface. This strategy was tested by some blog users and found to be profitable in the short term. The book is the revised edition of Murphy’s earlier book, ‘Technical Analysis of the Futures Markets’, which was cited in research papers by the Federal Reserve and used in training programmes by the Market Technicians Association. For almost half a century, as China pursued a planned economy under Mao Zedong, the concept of an equities market was anathema to the country’s economic structure. If the price of a share goes up from $100 to $105, the value of the derivative will increase by the same amount. It makes the trading style more manageable and sometimes easier to execute under pressure.

Commodities

Many choices, or embedded options, have traditionally been included in bond contracts. And novices aren’t the only ones playing with Monopoly money; experienced traders use virtual portfolios to test out new strategies or try out trading platform features. Bajaj Financial Securities Limited’s Associates may have actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report. Initial profit targets are set at the size of the island formation projected in the direction of the breakout. Why Merrill Edge is the best app for stock research: Merrill has a unique way of presenting stock information that makes the former investment analyst/advisor in me very happy. Trading has many aspects, and one needs to study them all to be a successful trader. Update your mobile numbers/email IDs with your stock brokers. One needs to work on the emotional part regularly to accept the outcomes. I’ve spent a good amount of time using their customer service support as well as a Schwab Financial Consultant and both have been tremendously helpful.

Equity delivery Brokerage Charges

MCX 10575 NCDEX 00109 NeML 10042 NSEL 10180 SEBI Registration No. Scan to downloadthe app. Get tight spreads, no hidden fees and access to 10,000+ instruments. Newer traders looking to minimize costs while enjoying a low barrier to entry will like AvaTrade’s competitive spreads, no commission trading structure, and low $100 account minimum. OpenAI could reach $150 billion valuation. Relying solely on historical performance or backtesting results without considering changing market dynamics can lead to losses. Commodities CFDs present another opportunity for position trading, spanning energies, metals, and agricultural products. Stock day trading and other types all come with different risk levels, but some day trading principles still apply to nearly everyone. As such, many strategies are applicable to both, with the caveat that the time frames vary. Since you are dealing with a minimal set of shapes when trading tick charts, it might be helpful to use a few indicators to complement your tick chart analysis–particularly those that measure volume liquidity, momentum, and potential overbought/oversold levels. For existing Bank of America customers, the universal account access and functionality make the app an easy winner. However, novice traders must refrain from trading on margin as it might increase their loss if the trade does not favour them. Remember, these are thumb rules and not recommendations. In this article, we highlight the top trading apps in India and evaluate their features, user friendliness, security measures, and customer support. A balance sheet is the last drawn financial statement which reports a company’s assets, liabilities, and the shareholders’ equity at a particular year in time, and provides a basis for computing the rates of return and evaluating the capital structure of the company. Most paper trading simulators limit access to 30 days sometimes they may go as long as 90 days, which should be enough time for you to familiarize yourself with the platform. Without leverage: Your 50 shares decrease in value to $18 per share. 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra E, Mumbai 400051. High probability trades are still speculative trades, which means traders take on the risks to get access to the potential rewards. Flags and pennants work well for intraday trading because they can signal short term sentiment shifts and momentum changes within the trading day that traders can capitalise on for quick profits. At the same time, the model generates hedge parameters necessary for effective risk management of option holdings. An investor may write put options at a strike price where they see the shares being a good value and would be willing to buy at that price. Business Insider’s rating methodology for investment products considers pricing and fees, investment options, account types, investment platforms, investment research, and educational resources. Clients can browse the stats of Master Traders, including risk score, gain, profit/loss, number of copiers, commission, and trade history.

Table of contents

Brokerage will not exceed the SEBI prescribed limit. “The trend is your friend until the end, when it bends. Trades are recorded in official books, and executed through recognized exchanges. Decide what type of orders you’ll use to enter and exit trades. Read the FXOpen article to learn the unique features of the double bottom formation and find out how to use it in trading. To view or add a comment, sign in. A commonly used strategy world over, breakout swing strategy relies heavily on having good technical analysis skills. If an investor buys $100,000 worth of EUR/USD, they might be required to hold $1,000 in the account as margin. Hundreds of ETFs for customization. The pilot program began in October 2016 and ended two years later. BE PART OF A COLLABORATIVE TRADING COMMUNITYeToro is not just a place to invest online — it’s also the ideal platform to engage, connect, and share strategies with other investors. Bollinger Bands® Indicator.

Trading Account

You buy 1 share, or you might buy 10 shares. Prioritising your needs has helped us become the leading European online broker. Fidelity is a repeat winner in this category, after earning the top spot from Charles Schwab in 2023. As the value of the stock position falls, the put increases in value, covering the decline dollar for dollar. But if the money in your account falls, due to your loss making position, you’d immediately be placed on margin call. Thanks in advance for any insight you can provide. The volatility of a stock is the amount of movement in the stock’s price over a certain timeframe. Account would be open after all procedure relating to IPV and client due diligence is completed.

Key Questions to Ask a Business Mentor for the Best Insights

Note that for a delta neutral portfolio, whereby the trader had also sold 44 shares of XYZ stock as a hedge, the net loss under the same scenario would be $15. It’s about monitoring the ability of the strategy to capitalize on short term price moves and the success rate of the trades. Thanasi Panagiotakopoulos, CEPA, MSF, BFA. No worries for refund as the money remains in investor’s account. Yes, one can use as many apps at the same time as per their requirements and needs. Candlestick patterns, in particular, are invaluable for identifying trend reversals and continuations. Learn to spot signals, understand short squeezes, and boost your trading success. Technical and other issues can be resolved through the broker’s customer care service. Selling a cheaper call with higher strike B helps to offset the cost of the call you buy at strike A.

Platforms

And that’s all there is to it for the best UK trading platforms. IPO Financing is done through Bajaj Finance Limited. I started LivingFromTrading as a way to give people a simple and effective way to learn about trading financial markets. Financial markets are in a constant state of flux, oscillating between uptrends and downtrends. Position trading means taking a position in the market and holding it for months or even years. The lower shadow must be at least twice as long as the candle’s body, and there must be a small or no upper shadow. Binary options are based on a yes or no answer, and the buyer receives a payout or nothing at expiration. Trendlines will vary depending on what part of the price bar is used to “connect the dots. Finance charges and other income are normally shown separately from administrative expenses. Lower cost, ease to access, high leverage to gain maximum profit. Details of any arising conflicts of interest will always appear in the investment recommendations. The GTF options course is very important for traders to manage their risk, generate income, and take advantage of market opportunities. Annually, that’s $25 per $10,000 that you invest. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Screeners is not Exchange approved products and any disputes related to the same will not be dealt on the Exchange platform. My journey in Academia started in 2009 as I discovered my passion for learning and teaching. Often the more volatile or less liquid an underlying market, the lower the leverage on offer in order to protect your position from rapid price movements. The M pattern’s clear price peaks and troughs are also evident on the Kagi charts. More sophisticated models are used to model the volatility smile. Only engage in bot trading if you possess sufficient knowledge or seek guidance from a qualified financial advisor. Instead of buying an asset directly e. STINU Position Size Calculator. For more details you can refer to our cookie policy. For security reasons, we have logged you out of HDFC Bank NetBanking. When we refer to a product as the ‘best’ this reflects our assessment according to specific criteria. Scan to download Trading. Past performance is not necessarily indicative of future results. The volume of Trades: The trading app enables traders or investors to quickly execute big volume deals and quickly profit from their investments. Stay updated with the latest news and trends in the cryptocurrency world through our official channels:Bybit Announcement: ybit Blog: ybit Learn: ybit Help: oin the vibrant community of Bybit traders:X: ybit OfficialFacebook: ybit/Instagram: official/Telegram: ybitEnglish.